Creative Realities (CREX): Digital Signage Leader

Overlooked SAAS Business creates compelling potential return, 100%+ Upside

Long | Current Price: ~$2.80 | Price Target: ~$7.25

Background

Creative Realities, Inc. (CREX) provides digital signage experiences designed to influence behavior, inspire action, and drive profitability for its customers across a wide range of industries. The company installs these digital signs and provides a software platform to help its customers manage thousands of connected devices day-to-day. The company has four software platforms, including ReflectView for digital signage management, Clarity for digital menu board management, Clarity for automotive customers, and Reflect AdLogic for managing advertising on digital signage.

FY 2023 Revenue is expected to be ~$47M with ~$4M in EBITDA. The company expects to exit 2023 with $15.6M in SAAS ARR and has over 375k connected devices (“SAAS billable endpoints”) operating on its software platform. The company’s major customers include Macy’s, Stellantis, Verizon, Panera Bread, 7-11, and Best Buy, among others.

Key Investment Highlights

Sizable and Growing Market for Digital Signage: $20B digital signage US market, brick-and-mortar points of interest (retailers, QSRs, sports venues, hospitals, doctor’s offices, etc.) need to thoughtfully engage with customers through the use of digital signage that features dynamic, timely and relevant content which static, paper boards can't deliver on. Most of retail, despite the rise of Amazon and other providers, is still conducted locally (90%+ pre-pandemic) and thus the need to engage with customers remains a focus for any business with foot traffic. Per the Management team, there are ~2M digital signs that are installed in the United States per year, providing a clear path to grow for many years to come.

Highly Fragmented Industry: Over 200 competitors operate in this space in the United States, and most are subscale SMBs (~40 or so employees, $3M to $8M in revenue on average with limited ability to scale and usually one big customer) that were previously Audio Visual (AV) companies. These companies do not offer end-to-end digital signage management nor do they have the ability to win big national accounts given the lack of scale.

CREX is a clear differentiator in this highly fragmented industry: one of the only fully integrated, end-to-end, scaled platform solutions for digital signage management with expertise in a broad array of industries that can meet the needs of large, national companies with thousands of locations.

Digital signage does not start and end with the installation of a digital sign. Beyond site design and installation, there is content creation and management, device management, analytics, media sales / ad monetization, repairs / maintenance, to name a few. Creative Realities addresses end-to-end digital signage management through its hardware sales, installation, various services, and software solutions for day-to-day management. This scaled, one-stop-shop offering provides a valuable proposition to customers.

Per the Management team, their RFP win percentage was 70% over the past 12 months, and the platform and personnel are widely acknowledged by customers as best-in-class.

Blue Chip Customer Base with Big Logo Wins in Recent Years: the best-in-class and scaled offering is exemplified through the company’s stellar and long-standing customer base with large customers, including Best Buy (75k connected devices), Macy’s (all locations), Verizon (27k connected devices), 7-11 (4k locations), AT&T Stadium (home of the Dallas Cowboys, 3.8k connected devices), Chanel, Cedar Fair / Six Flags, Stellantis (2.7k connected devices), among others. The company continues to prove its capabilities through big customer wins including Panera Bread (2,000 locations), Black Rifle Coffee Company and Strike Ten Entertainment (the marketing arm of the Bowling Proprietors Association of America) in recent years.

Furthermore, the company has $110M in backlog, demonstrating the customer value proposition and providing revenue visibility for the foreseeable future. The company has pointed towards a pipeline that is 3x the size of the backlog. As more devices are installed, this seeds the SAAS revenue component of the business model, which leads us to the next point…

Underappreciated & Misvalued SAAS Business: while hardware sales and hardware installation / services tend to be more one-time in nature, lower margin, and thus lower-quality, the hardware installation seeds SAAS revenue per device installed, which creates a recurring revenue, high-margin (~80%) cash flow stream over many years to come.

The market overlooks and misvalues the software business embedded in CREX, as evidenced by current trading multiples. Creative Realities Annual Recurring Revenue (ARR) from the SAAS piece was ~$15.6M in 2023 and is expected to grow to over $18M in 2024. The current ARR figures are likely artificially deflated given several legacy contracts (from previous acquisitions) and are not priced to market. Our estimates suggest that $8 to $10 per month per device would be market rate pricing, which at the current installed base of ~375k devices, would imply between $36M and $45M in ARR. This suggests that as the company’s contracts are renewed, updated pricing alone will be a huge unlock in addition to the realization of the backlog and new customer wins.

We’ll discuss how to objectively value the SAAS business on a standalone basis leveraging relevant SAAS trading multiples in the valuation section, but as it stands today, the company trades as a subscale, digital signage hardware installer (trading at <1x Revenue). As the company executes, the stock eventually gets re-rated to account for the high-quality SAAS component embedded in the business through a sum-of-the-parts (SOTP) valuation methodology.

The company has made progress in providing investors with the necessary metrics / reporting to properly recognize and value the SAAS component. However, there is still a long way to go on this front. While there were some system / data limitations to providing a more robust set of metrics in the past, the hope is that the Management team will operate more as a SAAS company and provide the right metrics (# of connected devices, ARPU, Net Dollar Retention, Customer Churn, ARR, Existing Customer Deployment %, LTV / CAC Payback, S&M as a % of Revenue, etc.) to help investors and analysts model the true earnings power of the company and unlock additional shareholder value.

2024 is poised to be a key inflection year with accelerating revenue growth and improving margins: the company has historically made key acquisitions in the past to grow its product offering, and in particular, the 2021 acquisition of Reflect Systems, Inc. improved its software capabilities greatly, making the company one of the few truly integrated end-to-end digital signage solutions providers in the US and fully rounded out the platform. With the integration of the acquisition complete, the company is positioned to compete effectively in the market on a go-forward basis with strong revenue acceleration and flow-through to EBITDA.

FY 2024 Revenue of $60 million to $80 million represents between 23% and 65% revenue growth YoY.

FY 2024 Adjusted EBITDA of $7.2 million to $12.0 million represents between 80% and 200%growth YoY.

Projected FY 2024 exit ARR run rate of $18.0 million.

Beyond 2024, given the secular tailwinds of businesses adopting digital signage, the industry is expected to grow ~8% through 2030, providing ample runway over the next 5+ years. In addition, given the fragmentation of the industry, CREX has the opportunity to be a serial acquirer, consolidating smaller players through M&A.

Strengthening Balance Sheet: As the company generates FCF, it is aggressively paying down debt (~$500k per month), giving it more flexibility / dry powder to explore strategic opportunities. As mentioned in the Company’s Q3 earnings call, “We entered 2023 with net debt of $19 million and a leverage ratio of approximately 4.9x. As of the end of the third quarter, our net debt is $8.4 million, and our leverage ratio has reduced to 2.6x utilizing trailing 12-month adjusted EBITDA. While our public offering in August was instrumental to reduce our debt, it is not the only factor at play to reduce leverage. With the revenue and profit projections that we have communicated for 2024, we project a 2024 exit leverage ratio of between 1.2 and 1.5x…”.

Experienced, Incentive-Aligned Management Team: Rick Mills, CEO, has operated in the digital signage industry for nearly 15 years and is a top 5 shareholder and aligned with shareholder interests. The Management team, led by Rick and Will Logan (CFO) have shepherded the company through the pandemic and positioned the company well for future growth and profitability and has shown a willingness to engage with investors and has been receptive to feedback.

Introduction of a Channel Partner Program: there are hundreds of thousands of SMBs who will be upgrading to digital signage solutions in the coming years. Many of these locations are single locations or operate a handful of locations, which does not present a large enough selling opportunity for Creative Realities to pursue, however, through a channel partner program, the company can leverage its software platforms to smaller integrators under a SAAS-based subscription license model. There is a huge underpenetrated SMB market available for digital signage software and services. While this is unlikely to be a material driver in 2024, this provides another high-margin, capital-light growth vector for the company going forward to grow the number of SAAS billable endpoints.

Solid Downside Protection: At current prices, there is a reasonable margin of safety and downside protection. In 2023, CREX’s largest shareholder (Pegasus Capital Advisors) made an unsolicited offer at $2.80 per share, and since then, the business has continued to execute and build more momentum by winning more customer logos and delivering on the backlog (e.g. kick-off of the Bowling Contract). With shares currently trading at ~$2.60, this provides some downside protection for the stock and serves as a pseudo floor for shares over the medium term.

Valuation & Position Sizing & Catalyst

Using a few valuation approaches, the estimated fair value is between $6.00 and $7.50 per share, which presents a ~120% to ~1900% return from today’s price of ~$2.60. Please refer to Figure 3 for a detailed build-up of the financial model.

As mentioned earlier, the SAAS component embedded in the business is misunderstood and misvalued. The SAAS revenue is in the 80% margin range and tends to be sticky with multi-year contractual commitments and low churn (<1%) and 100%+ net dollar retention rates. This warrants a considerably higher revenue multiple, however, for the sake of conservatism, a 2x to 3x Revenue multiple is assumed in the low, mid, and high scenarios in the SOTP methodology.

Public SAAS companies trade anywhere between 4x and 14x NTM Revenue, largely dependent on growth rates, stickiness of revenue and margin profiles. Please refer to the Appendix (Figures 4, 5, 6) for some charts provided by Jamin Ball (Altimeter Capital) from his Clouded Judgment newsletter.

Overall, a 2x to 3x NTM Revenue multiple on the SAAS business would be below the 25th percentile of publicly traded peers, which is quite conservative. If the SAAS revenues continue to accelerate, there is no reason why the SAAS piece can’t be valued between 6x to 8x Revenue, as the company’s SAAS operating metrics are very much in line with its publicly traded peers, albeit, at a smaller scale. The smaller scale vis a vis much larger software companies is captured in the sub-25th percentile EV / NTM Revenue Multiple assigned to CREX’s SAAS business.

Other valuation approaches were utilized, including a traditional DCF and multiples (EV / Sales, EV / EBITDA, P/E) in addition to the Pegasus Bid serving as the floor to arrive at a $6.00 to $7.50 price range. If the company can execute and hit its North Star of 1M connected devices, this stock has much greater compounding potential over a multi-year period. In the interim, we will remain cautiously optimistic and see how 2024 plays out before getting more bullish on the company’s prospects.

The figures in the Valuation Summary account for the warrants the company has issued in connection with previous debt and equity financings in addition to the options issued to employees as part of stock-based compensation. The company has a sizable warrant / option overhang, with nearly 7.4M warrants and options outstanding at varying strike prices between $3.00 and $25.22. While this level of dilution is not ideal, a huge part of this dilution would not occur without significant price appreciation from today’s levels, given how out-of-the-money these warrants / options are. The potential dilution was accounted for using the treasury stock method in determining the per share fair value. Please refer to Figure 7 in the Appendix for additional detail.

One other notable call-out: in connection with the company’s November 2021 acquisition of Reflect Systems, a part of the purchase consideration included a future earnout, of which the amount is subject to Creative Realities’ stock p[rice as of February 17, 2025, with a potential option held by the company to extend this date by six months to August 17, 2025. The earnout is calculated as $19.20 per share less the average closing price per share of Creative Realities common stock in the fifteen (15) consecutive trading day period ending February 2, 2025 multiplied by the number of shares issued to Reflect shareholders (~778k). This essentially serves as a true-up to $19.20 per share for Reflect shareholders. This future earnout liability is valued simplistically, by subtracting $19.20 from the midpoint of the fair value range highlighted in the Valuation Summary ($19.20 less $6.65 x 778K shares), equaling about $9.7M in total value, reducing equity value by ~$1/share.

As far as position sizing, given this is a small-cap company with debt, a max allocation position of 3% to start is recommended with the ability to incrementally add to the position, up to 5% to 6% of the total portfolio as the business executes on the 2024 plan and beyond.

The catalyst to unlocking this upside could be a broader understanding of the SAAS business through improved disclosure and reporting and ongoing business performance in 2024. The recommended holding period is one to two years.

Key Risks

Small-cap company: ~$25M market cap with low volume that is unlikely to receive any incremental institutional interest or analyst coverage until much larger. There are currently only a few lesser known sell-side firms covering the stock (e.g.Alliance Global Partners and Taglich Brothers). Small-cap stocks can be volatile with huge single-day movements (+/- double-digit moves) on no news. The current macroeconomic setup (slowing growth, sticky inflation) may not favor small cap factor exposure.

US Macroeconomic / Recession Risk: marketing budgets and Capex budgets could be pared back as digital signage may be seen as a more discretionary line item in a tightening consumer environment.

Digital Signage Customer Adoption: there are several large companies, even today, that continue to operate static boards, including Starbucks. Adoption of digital signage is still in the early innings and this transition could continue to be prolonged.

Missed Project Delivery Schedules: while the company has $110M of backlog, this backlog must be realized and it is heavily dependent on its customers and their propensity to move forward in a timely manner on the orders placed. Any slippage on timelines pushes revenue out.

Warrant Overhang: the warrants issued as part of prior financings will drive further dilution, albeit at much higher prices, given the weighted average exercise price is ~$6.51. This provides resistance at higher price points, which could cause the share price breaking past a $6 ceiling challenging over the next twelve to eighteen months.

Debt Position: Nearly $15M in debt with ~$9M of cash on the balance sheet. If projects are delayed further, debt paydown could be an issue.

Appendix

Figure 1: Digital Signage Market ~$20B, growing 13% from 2021 to 2025

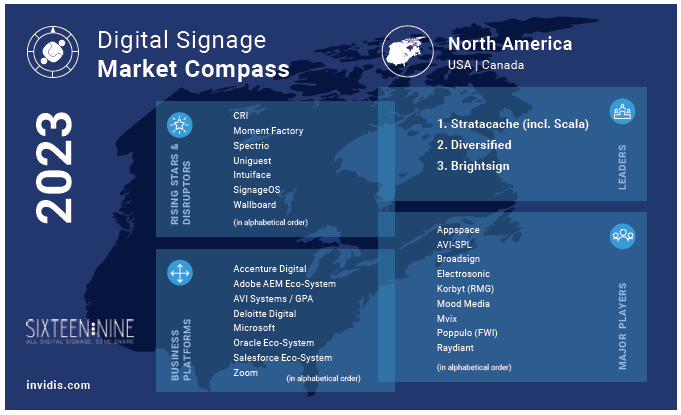

Figure 2: US & Canada Digital Signage Players, with Creative Realities as a Top 5 Player

Figure 3: Financial Model Assumptions

Figure 4: SAAS EV / NTM Median Revenue Multiples between 4x and 14x, broken out by growth

Figure 5: EV / NTM Revenue Multiples across SAAS Universe, 25th percentile in the 4x range

Figure 6: SAAS NTM Revenue Growth to NTM Revenue Multiple, 15% Revenue growth could garner ~6x Revenue Multiple

Figure 7: Options and Warrants Issued and Outstanding

Hi Abi, really enjoyed this write-up and I've been following this name as well. Just out of curiosity, where are you getting those endpoint figures that you mentioned, specifically for their retail customers?

By the way, what's your take on their latest contract with IceBox? Based on locations and end points, seems like one of their more significant contracts to date