Position Update - FL & PRPL Earnings

Remain Long FL & PRPL given improving underlying business fundamentals

Foot Locker (FL): Q4 2023 Earnings Recap & Looking Ahead

“We see strong results happening with our Lace Up plan and we are committed to continuing to invest in those strategies. These green shoots we’re seeing encourage us that this is the right path for us and it really drives us in terms of being a really sustainable long-term, great omnichannel retailer.” - Mary Dillon, CEO, Q4 2023 Earnings Call

Foot Locker reported Q4 2023 earnings on March 6, 2024, resulting in a stock decline of over 30% post-release. Much of this downturn stemmed from weaker-than-expected FY 2024 guidance. However, it's important to note that our investment thesis extends far beyond this quarter. The focus remains on the long term, spanning multiple quarters. I maintain confidence in Mary Dillon's leadership, as the core thesis remains unchanged. Despite market reactions, the team continues to drive positive momentum in executing the Lace Up strategy, which investors and analysts may be undervaluing.

Thus, I reaffirm our long thesis, with a 12-month price target of $50, slightly revised from $55, offering over 100% upside potential.

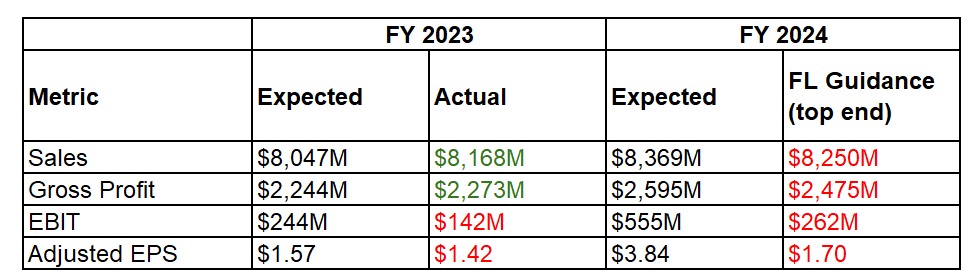

The Numbers

What We Liked

Enhancing Nike Relationship: “our return to Nike drives improved returns in margins, especially within the back of the year”

Robust SSS Comps for North America Foot Locker and Kids Foot Locker: Both banners experienced positive SSS comps, with growth rates of 4.8% and 6.9%, respectively, in Q4 2023.

Optimized Inventory Position: Inventory levels have decreased by 8% YoY, facilitated by strategic promotional activities aimed at clearing out aging inventory. This sets the stage for margin recovery in 2024.

Sustained Cost Structure Improvements: The company achieved $135 million in cost reductions as part of its $350 million cost-saving initiative. Streamlining costs enables strategic investments in enhancing the customer and brand partner experience, spanning digital initiatives, loyalty programs, and store enhancements.

Continued clarity and execution in Lace Up Strategy:

Expand Sneaker Culture

Held a Partner summit to enhance data sharing and tell compelling brand stories to mutually benefit partner brands & FL

New basketball activations, including All-Star weekend, generated over 1 billion impressions through a 50k square foot activation in Indianapolis

The company is doing a great job leveraging events, in-person activations, and social media to narrate its story. Check out the new ad spot featuring Kevin Durant and Jayson Tatum here.

Power Up the Portfolio

Continued transformation of real estate footprint with store refreshes and new format stores. Shift to off-mall locations was 39% in North America, up 5%.

Initiating clean-up efforts of poorly performing banners such as Champs.

Deepen Relationship with Customers

“We are driving greater considerations, brand awareness and customer acquisition at strong incremental returns…the work is giving us the confidence to increase our marketing and brand building spend in 2024.”

Loyalty program accounts for 21% of sales.

Best in Class Omnichannel:

Improving digital presence and better integration of channels is underway.

Digital sales were 19.5%, with double-digit gains in customer acquisition and a 9% digital comp increase.

Enhanced search and discovery capabilities, product listing and detail pages, improved storytelling, and continued cart optimization improvements are driving higher conversions.

Digital conversion is at an all-time high, with store conversion also up, online order traffic, and omni average order value (AOV) increased.

Introducing a new mobile app later in the year.

What We Didn’t Like

Q4 2023 Gross Margin: Experienced a 350 basis points YoY decline, largely attributed to lower merchandise margins resulting from heightened promotional activities. Although transient, it underscored the prevalence of inflated inventory levels industry-wide, which may persist for a while longer.

Weaker Guidance across Revenue, Gross Margin, and Operating Income: Proactively managing expectations, the company issued conservative guidance. However, it anticipates a return to positive SSS, setting a reasonable benchmark for potential future upward revisions.

Long-Term Financial Targets: Deferred from 2026 to 2028. While I appreciate Management's cautious stance, the 2026 timeline allows for ample time to enact various strategies. I maintain confidence in the company's ability to achieve the stated long-term EBIT Margin of 8.5% to 9% well in advance of 2028.

Purple Innovation (PRPL): Q4 2023 Earnings Recap & Looking Ahead

“Extremely encouraged by the response to our new product lines from both consumers and our wholesale partners. Encouragingly, the green shoots we saw in the fourth quarter have continued into 2024…” - Rob DeMartini, CEO, Q4 2023 Earnings Call

Purple Innovation reported earnings yesterday, March 12, 2024. Overall, the positive momentum in the business is encouraging, especially evident in the results of the new product launches in May 2023. Particularly promising is the outlook for Q1 2024, with revenue guidance in the low to mid-teens growth. While the guidance for FY 2024 was somewhat conservative in light of Q1 2024 revenue acceleration thus far, we understand Management's cautious approach. We believe we're at an inflection point, poised for significant revenue and cash flow acceleration. I maintain my price target of $2.50 and would consider adding to the position on any short-term weakness.

The stock has dropped approximately 15% since the announcement. This decline seems to be driven by market flow dynamics rather than fundamental issues, offering buying opportunities for long-term investors. Short-term momentum investors, attracted by the stock's 100% surge since January, are likely selling off after the earnings release.

Additionally, the 10K was released yesterday afternoon. We are currently reviewing it and will provide updates accordingly.

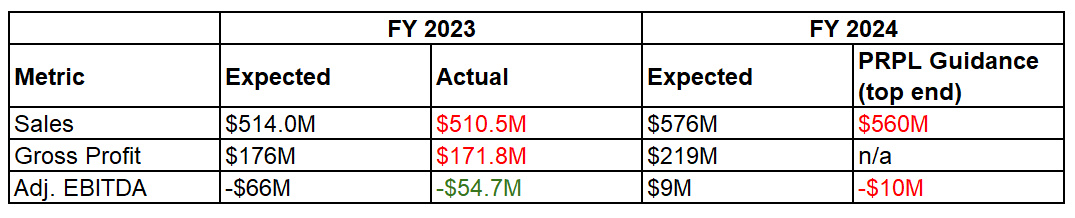

The Numbers

What We Liked

Improved Sales Trends across Channels: In Q4, net revenue reached $145.9 million, marking a 1.1% increase compared to 4Q22 and a 4.2% increase compared to 3Q23. Wholesale floor slots also saw a significant uptick, increasing by 10% year-over-year.

Early signs of business performance inflection are evident: "The fourth quarter represented an encouraging finish to 2023 as sales finished within our guidance range and increased year-over-year for the first time in eight quarters. ”This positive response can be attributed to the launch of the Company's new Premium and Luxe products in May 2023. Notably, these new products command higher prices and margins.

Narrowing losses sequentially: The Q4 operating loss was $(16.2) million, compared to $(11.9) million in 4Q22 and $(32.6) million in 3Q23. Fourth-quarter profitability met expectations, highlighted by positive operating income in December.

Improving Inventory Position: Inventories decreased by 8.6% to $66.9 million compared to the end of 2022.

2024 Outlook: Albeit lower than my original expectations, the company anticipates sequential improvement in quarterly revenue and adjusted EBITDA performance throughout the year, with positive adjusted EBITDA and cash flow expected in H2 2024.

Improving Management Execution: Management's strategic initiatives, including enhancements to manufacturing, supply chain, product engineering, and new product and marketing strategies, have positively impacted purple.com site traffic. Additionally, recent upticks in conversion, despite sluggish industry trends, indicate market share gains, top-line acceleration, and enhanced margins.

What We Didn’t Like

Softer than Expected Guidance: Management provided FY 2024 revenue guidance of $560 million and Adjusted EBITDA of ($10.0) million, falling short of my projections of $576 million in revenue and $9.0 million in EBITDA. Although QTD Q1 performance displayed robust low to mid-teens revenue growth, Management maintained a cautious outlook for the full year, citing ongoing industry challenges and macroeconomic conditions. While Management's caution is understandable, it positions the company for potential beat-and-raise opportunities throughout the year.