Purple Innovation (PRPL): from restless nights to restful sleep in 2024

Strong mattress brand, differentiated gel technology and recent product refresh sets up stock for 2024 rebound, 200%+ upside

Long | Current Price: ~$1 | Price Target: $2.50

Background

Purple Innovation, Inc. offers a variety of branded and premium comfort products, including mattresses, pillows, cushions, bases, sheets, and more, primarily in the United States. It develops its products, through its proprietary gel technology, Hyper-Elastic Polymer. It markets and sells its products through a direct-to-consumer e-commerce website, Purple-owned retail showrooms (~55 in total), and retail wholesale partners (~3,300 doors and ~5 slots per door) such as Mattress Firm and Ashley Furniture. The company went public via SPAC in May 20218.

Key Investment Highlights

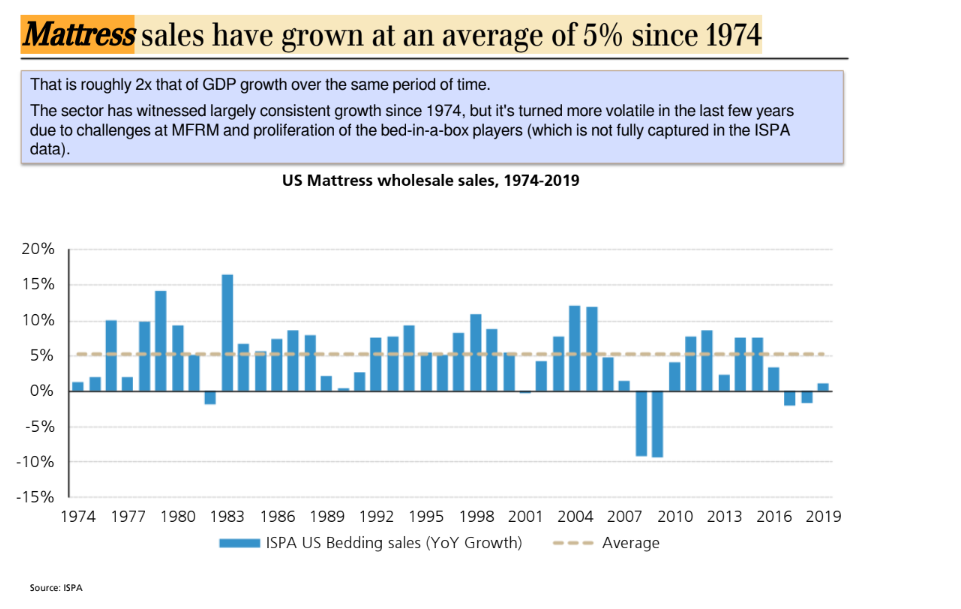

Purple Innovation is a highly disruptive mattress company with differentiated and patented gel grid technology in a large (~$25B+), sticky and growing mattress / bedding industry (5%+ CAGR). Please refer to Figures 1 and 2 in the Appendix.

The US mattress industry has remained fairly stagnant, with limited levels of innovation. Innerspring mattresses were popularized in the 20th century , memory foam mattresses in the early 2000s by Tempur Pedic (TPX) and personalized sleep customizations by Sleep Number (SNBR) over the last decade. Purple’s gel grid technology is quite differentiated, patent-protected (100+ patents) and has been one of the more recent disruptions in the mattress industry as consumers place a huge value on high-quality sleep to ensure optimal health and wellness.

Purple is a highly relevant brand with strong brand awareness and a loyal customer base. Consumers recognize the brand and have a high intent to purchase Purple products. In surveys, customers overwhelmingly agreed that Purple provided better pressure relief, temperature regulation and body contouring support compared to their previous non-Purple mattresses. The company saw great demand for its products in 2020 and 2021, growing revenue by 51% and 12% to $726M in FY 2021. After generating $65M in EBIT in FY 2020, the company has struggled to drive profitability in recent years, losing money in both 2021 and 2022 (EBIT losses of $23M and $39M) despite record sales in 2021. The company’s struggles are not a brand or product problem, it is a management / execution problem. Please refer to Figures 3 and 4 in the Appendix.

In response to the sales slowdown and lack of profitability, the company is undergoing its biggest product overhaul, introducing 11 new products in 2023 and focusing on moving upmarket to focus more exclusively on higher-end, higher-margin products ($5,500 to $7,500 luxury mattresses as an example). See videos of the company’s Sleep Better, Live Purple marketing campaign. These products, if executed and marketed well, provide a return to free cash flow generation / profitability in 2H 2024, which should help build more institutional interest in the company over time. The company has signaled that the product refresh is going well, which creates a nice setup for revenue and earnings growth in upcoming quarters.

Attractive Valuation with Recent Acquisition Bid Price Support: The stock price has fallen 75%+ since an acquisition offer took place and is down 90% since going public. In September 2022, Coliseum Capital Management, an activist investment firm, made an unsolicited, non-binding proposal to acquire all of the outstanding shares of Purple that it did not already own. At the time, Coliseum owned approximately 44% of Purple's outstanding shares and was its largest shareholder. The proposed acquisition price was $4.35 per share, representing a roughly 28% premium over Purple's closing price on the day before the offer was announced.

The Board of Directors eventually rejected the bid in 2023 and the company and Coliseum Capital reached a Cooperation agreement (whereby Coliseum would not acquire additional shares, and could bring on new independent Board members, among other things). This Cooperation agreement expires in 2024 after the Annual Meeting takes place, which at that point could serve as a catalyst for potential value creation through M&A

Several viable growth verticals / strategies exist: 1.) continued wholesale distribution penetration, as the company in less than 50% of Mattress Firm locations 2.) international expansion (100% of revenues generated in North America) 3.) entry into adjacent verticals such as luxury automobile seats, desk chairs, etc. leveraging their proprietary gel grid technology. The company has not had the luxury to invest in additional growth engines given the limitations of the balance sheet, however, these opportunities provide ample runway for continued growth in the future. I would expect an astute Management Team to be thinking much longer term and investing prudently for the next three to five years, through either direct investment or licensing agreements. There is value in the IP portfolio and with the existing brand awareness, a large, untapped opportunity to go into alternative premium comfort products outside of the core bedding vertical.

Reaffirmed 2023 guidance & Debt Refinancing: Management reaffirmed guidance in January 2024, which provides some assurance that the company has stabilized and is positioned to inflect going forward.

In addition, PRPL refinanced their debt by consolidating and upsizing their prior debt facilities (term loan + ABL) into one term loan held by Coliseum Capital, among others. The new $61M term loan has $21M undrawn, bringing cash and cash equivalents to $48M following the transaction closing. This gives the company sufficient liquidity to weather the storm in 2024

The refinancing provides PRPL with an additional $19M term loan if requested by the company.

High-level terms of the refinancing: Maturity date of December 31, 2026 (plenty of time for the product refresh to play out), Interest Rate: SOFR + 8.25% (10.25% if PIK), 20M warrants issued at an exercise price of $1.50 with certain stipulations around Coliseum not reaching a majority stake

While the increased flexibility helps execute the turnaround, the warrant issuance is highly dilutive (~15%). The warrant overhang is taken into consideration in the valuation section below. Furthermore, the refinancing provides Coliseum with increased control and involvement with the company. Coliseum Capital has a long-standing relationship with Purple and was heavily involved in the going-public transaction. Coliseum tends to have a good reputation, with a focus on long-term ownership and pushing for change that benefits all shareholders. While their intentions for the company are not fully known given their previous acquisition attempt / corporate governance struggle, the hope is that their increased involvement is a net positive for the company and share holders. Time will tell.

Valuation & Position Sizing & Catalyst

Using several valuation approaches, the estimated long-term fair value is between $2.00 and $3.00 per share, representing anywhere from 100% to 200% upside from today’s share price. Admittedly, this is a wide range, however, this is warranted given the range of potential outcomes for a small-cap company with limited near-term revenue and earnings visibility in the early stages of a product refresh.

The stock currently trades at depressed levels (<$125M Enterprise Value, EV / 2024 Sales of 0.2x vs. the historical average of ~1.0x EV / Sales) given the aforementioned risk factors and recent performance. Six sell-side analysts cover the stock, with three buy ratings and 3 hold ratings and the average price target at $3.

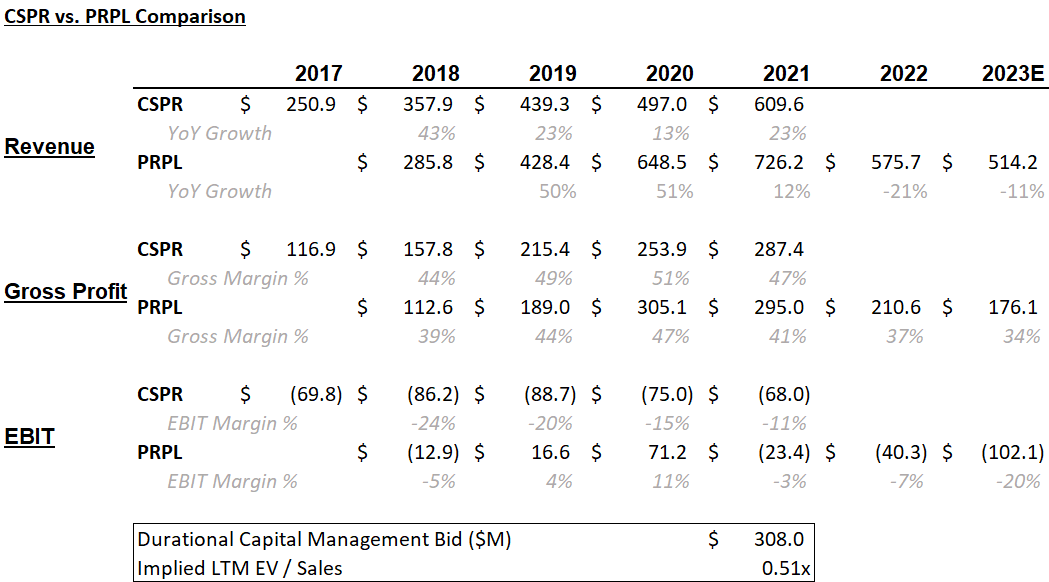

The Q3 2022 Coliseum Capital bid provides some price support as does the going-private transaction of Casper Sleep, Inc. by Durational Capital Management in January 2023. Casper Sleep is a fairly representative comp albeit smaller from a revenue standpoint and far less profitable from an operating margin perspective. Even conservatively applying a 0.51x EV / LTM Sales multiple implied by the Casper transaction to Purple would imply 140% upside from current levels. See below for a comparison Casper’s financial performance vs. Purple.

Ultimately, executing this strategy in the public lens will be challenging and potentially suboptimal to Purple. Management and the Board have had the time to turn things around and have missed the mark. Coliseum presented the company with a reasonable bid of $4.35 in 2022, which recognized the value of the company’s brand and differentiated gel grid technology while balancing the risks and macro headwinds ahead.

The most likely outcome is for Purple to be taken private by Coliseum Capital in the $2 to $3 range after there is increased signal and visibility into sales trends. A going-private transaction allows the company to be more long-term oriented (vs. feeling pressured to hit quarterly numbers imposed by Wall Street, issue guidance, etc.) and rebuild and reinvest in marketing around the new product launches while weathering any prolonged industry weakness.

Given how differentiated the gel grid technology is, it requires a healthy level of marketing to educate customers. With the pressure from Wall Street to become profitable in the short term, this makes fully investing in the brand / product portfolio more challenging. Navigating this transition in the unforgiving public markets is an uphill battle; it is distracting and ultimately value-destructive for a differentiated product with lots of untapped potential that requires healthy levels of marketing to educate consumers and grow top line.

The potential max upside is up to ~$4.00 per share in the best-case scenario, while the max downside is ~$0.50 per share (not based on fundamentals, but flows and past trading history), representing a 6 to 1 upside-to-downside opportunity, which reasonably compensates investors for the risks inherent in this stock. Ultimately, there is far too much value in the brand, the intellectual property and future growth opportunities for the stock to trade at these levels, particularly with the valuation support of the Coliseum 2022 acquisition attempt and a highly relevant transaction comp in the Casper Sleep deal in 2023.

Regarding catalysts, the 2024 Annual Meeting taking place sunsets the Cooperation Agreement between the company and Coliseum Capital, which opens up the possibility of a second acquisition attempt. The 2024 Annual Meeting is not formally scheduled yet, but expected to take place in June 2024 . As a point of reference, the 2023 Annual Meeting took place in August while the 2022 Annual Meeting took place in May. Other catalysts include improved sales / traffic trends from the newly launched product assortment.

As far as position sizing, while the upside-to-downside tradeoff is compelling, this is a volatile, small-cap play and as such, the recommended sizing is <5% of your total portfolio. If further green shoots arise around the new product launches, traffic trends, 2024 revenue / profitability, materialize, that could warrant increased sizing. In the interim, more progress needs to be seen before having that level of conviction to go bigger.

Risks

Please note that this is a small-cap stock with an enterprise value of ~$160M. Investing in small-cap stocks poses significant risks.

Management Team: The Management Team has lost some credibility after the struggles over the last two to three years. Losing money in a year of record sales in 2021 in retail combined with other missteps have eroded a lot of investor trust. The Management Team has limited visibility into the business, and has guided down multiple times in 2023. The Management team needs to show the ability to communicate the equity story more effectively and executed against stated goals to win back trust among investors. This is a wasted opportunity for a company with a great brand and a strong, highly differentiated product portfolio, but these are fixable problems.

Corporate Governance: In hindsight, the Board was wrong in not accepting the Coliseum Capital bid in 2022 and wasted time and resources (millions of dollars) in forming the Special Committee. The litigation and back and forth between Purple’s largest shareholder, Coliseum, and the company was not ideal and is likely to keep some investors on the sidelines without further progress from a financial / profitability perspective.

Accounting Restatements: The company has had to restate its financials due to issues in revenue recognition associated with its warranties. This is unacceptable for any publicly traded company; surprisingly, a US-based auditor was willing to sign off on these financials in the past. The company was accounting for warranty revenue incorrectly resulting in prior-period restatements with an impact on revenue and flowing down to EBITDA. Revenue recognition (ASC 606) is a nuanced topic, this is not a situation of management deceit / fraud, but rather interpretation of timing of revenue recognition for warranties associated with products sold.

The company has brought in a new CFO (Todd Vogensen, previously Party City, Chico’s, Michael’s, and Gap) and hopefully, he has revamped the Accounting / Controllership function as well. I would urge the company to revisit the selection of its current auditor, BDO in favor of a Big 4 Auditor to help rebuild investor trust in the company’s financials given the prior mishaps.

Potential Secondary Offering: While the balance sheet is relatively clean vs. other retailers going through a product overhaul, the company has a net debt position of ~$13M following the debt refinancing. Despite manageable leverage, there is still a chance of a secondary offering needed in 2024 to further fund operations if the company does not reach profitability / cash flow breakeven over the next 12 to 24 months. This places an overhang on the stock as equity holders may need to be diluted by another 20% to 25% to get through any rough patches. This risk is mitigated with the recent refinancing, but worth calling out.

Competitive Mattress Industry with Long Purchasing Cycles: PRPL is a small player in a highly competitive industry, representing 2% to 3% of the overall market. Consumers tend to purchase mattresses infrequently and purchase behavior tends to occur when moving / purchasing a new home

The weakening US Consumer amidst minimal housing turnover: new and existing home sales continue to be pressured given high interest rates and the lack of supply of existing home sales as homeowners are locked into low-interest rate mortgages. Mattress sales tend to be highly correlated to home turnover and this macro headwind undoubtedly places pressure on Purple and the industry at large.

PRPL Financial Model

Appendix

Figure 1: US Mattress Industry Model - $20B+ and growing

Source: UBS Research, October 2020, US Mattress Industry “Resting Easy for Now”

Figure 2: Mattress Sales Historical Growth Steady, growing 5% on avg since 1970s

Source: UBS Research, October 2020, US Mattress Industry “Resting Easy for Now”

Figure 3: Mattress Company Brand Awareness

Source: https://naplab.com/guides/mattress-advertising-statistics/

Figure 4: Online DTC Purchasing Behavior / Reasons for Purchasing PRPL

Source: UBS Research, October 2020, US Mattress Industry “Resting Easy for Now”

Figure 5: US Mattress Industry Market Share 2019A & 2023E

Source: UBS Research, October 2020, US Mattress Industry “Resting Easy for Now”

Figure 5: Channel Mix

Source: 10-Q, Q3 2023